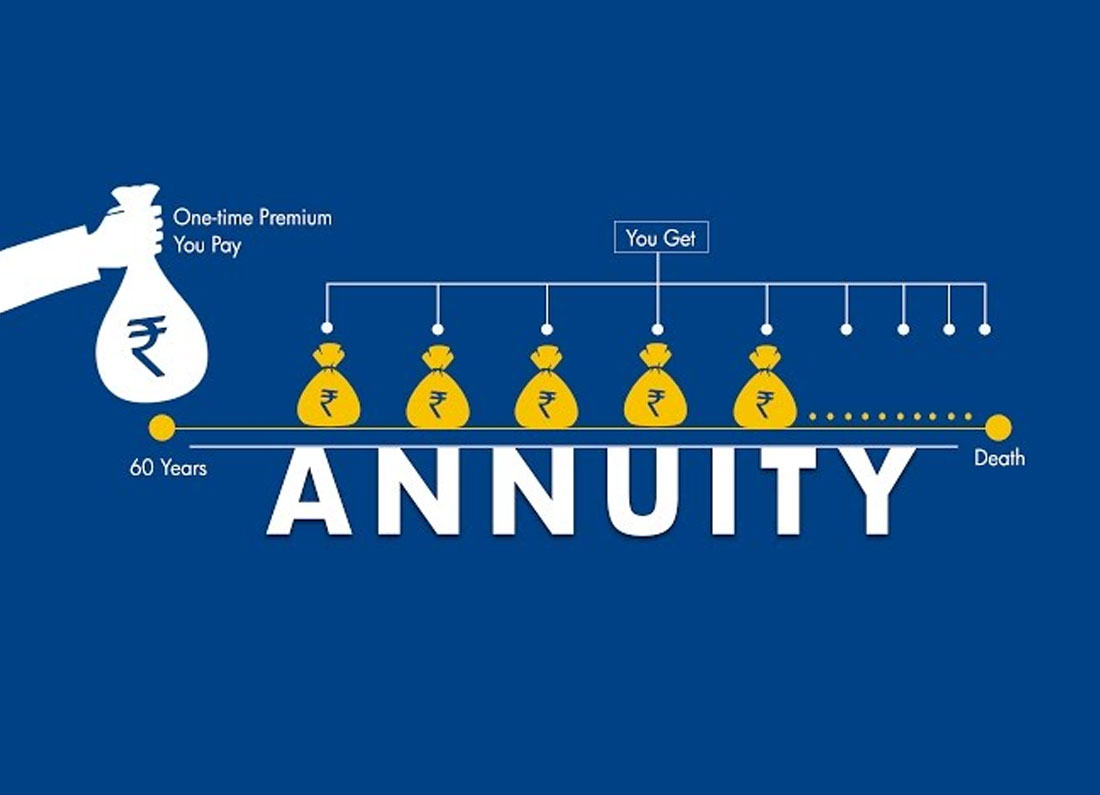

How do annuities work?

There are several types of annuities, but they all work on the same basic principle. You pay one or more premiums to an insurance company that invests the money to generate returns, which generally grow tax-free. Then, the insurance company uses those funds to make regular payments to you for the period of time specified in the annuity contract – a fixed number of years or the rest of your life.

Do you want to start getting income now – or later?

If you are already at retirement age and want payments to start within a year, you should consider an immediate annuity – which is typically purchased with a single lump sum payment. Otherwise, you can purchase a deferred annuity – with either a lump sum or series of payments – and funds in your annuity will grow tax-deferred for one or more years until you start taking income.

Types of Annuities

Fixed Annuity: A fixed annuity is a contract with an insurance company that is similar in many ways to a bank certificate of deposit. You pay one or more premiums to build up the account balance, and the insurer provides a guaranteed rate of return on that principal. Typically, the rate of return is guaranteed for multiple years, such as five years. After the initial guaranteed period, the insurer will reset the interest rate at regular intervals – usually annually – but the new rate cannot be lower than the guaranteed minimum interest rate in the contract.

Variable Annuity: A variable annuity allows you to accumulate tax-deferred savings and then receive regular payments during retirement, either for the rest of your life or for a specific time period.Gains earned during the life of your variable annuity grow tax-deferred. This means that you don’t pay taxes until the gains are withdrawn. A variable annuity offers various options that can help to give your beneficiaries a form of financial protection (typically referred to as a death benefit) in the event that you die during the accumulation period before you have begun to receive payments.

Fixed Index Annuities:A fixed index annuity is a kind of deferred annuity: A guaranteed contract with an insurance company designed to accumulate savings over time and provide income in the future. Your earnings typically aren’t taxed until you withdraw them. After the accumulation period, you can typically choose to receive a lump sum, spread payments out over a fixed number of years, or receive income for the rest of your life.

Unlike some annuities that expose you to market risk, fixed index annuities protect your principal until you decide to take guaranteed income in retirement while offering tax advantages, market growth potential, and a floor to protect against losses

Registered Index-linked:With a registered index-linked annuity, your growth potential is determined in part based on the performance of an underlying index or indices, so your money isn’t directly invested in the market. You have the flexibility to choose one or more indices that align with your investment preferences and objectives

Are annuities right for you?

An annuity can be an important part of your retirement planning strategy, along with 401(k) plans, pensions, whole life insurance cash value, and other assets. It can help you achieve a greater level of income stability, so that no matter how long you live, you won’t outlive that stream of income. Every person’s situation is different, but there’s a simple way to determine whether to consider an annuity. First, add up all known regular expenses you’ll have during retirement, then subtract other forms of guaranteed income, like a pension or Social Security. If there’s a gap, then an annuity may be a smart financial option. If the income you receive from an annuity can cover your fixed costs, you can spend your other retirement savings with greater confidence.