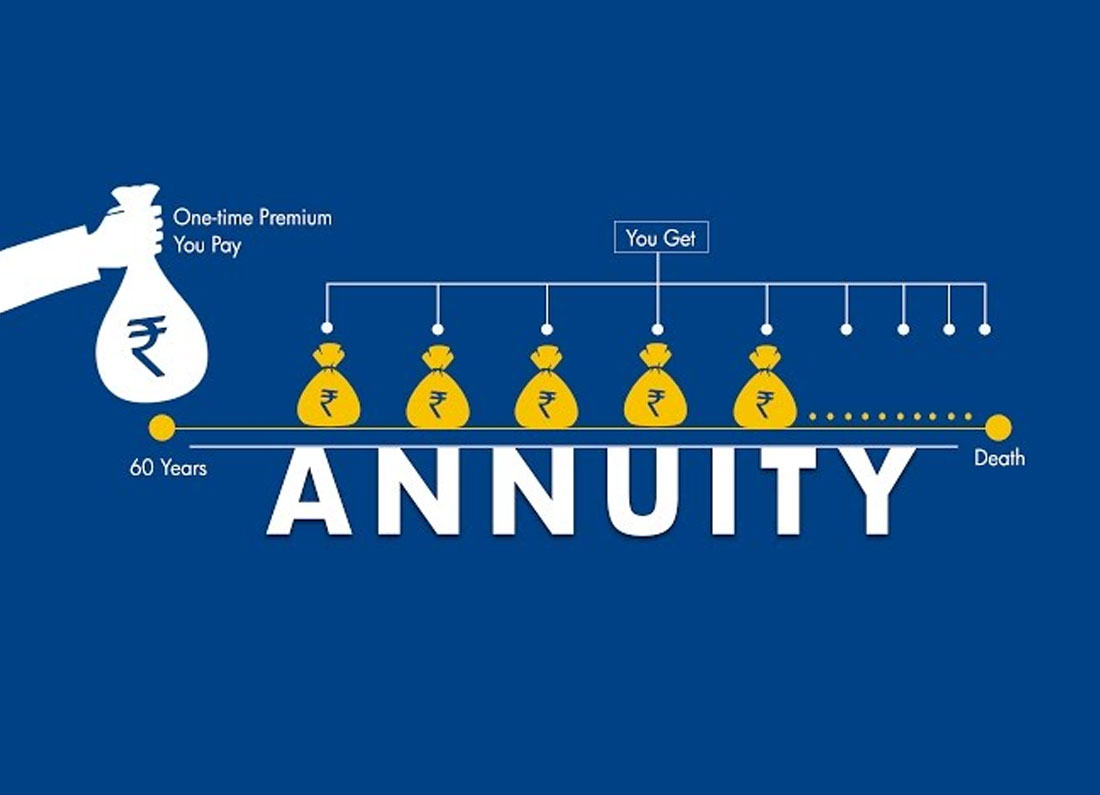

How do annuities work? There are several types of annuities, but they all work on the same...

The secret to getting ahead is getting started.

At SDV Financial Consulting Services, we provide our clients with comprehensive and personalized financial solutions. Our team of experts have years of experience in the industry and is committed to helping you achieve your financial goals. We take pride in getting to know our clients, in educating and empowering them with financial literacy to maximize their finances and protect from any uncertainties of life. We are licensed Financial Professionals to serve in every state of USA.

OUR FINANCIAL SERVICES

Financial Planning

We strongly believe that financial planning can be done at any phase of your life and should be dynamic in nature. Our professional planner will conduct a comprehension financial health check and help you reach your financial goals. The portfolio of services and solutions we offer are always aimed to meet yours and your family’s financial needs.

Tax strategies

We wish complaining about Taxes was a tax-deductible, but alas not to be. Thoughtful tax planning is vital for any wealth-management strategy. Our team will work with you to develop innovative tax strategies which aligns with your current financial goals and provides the most advantageous tax outcomes. Let us help you create a right balance between paying Taxes now, deferring taxes and tax advantage strategy.

Retirement Planning

Preparing for the future means building momentum toward whatever you want to pursue. Your retirement years bring the promise of realizing the goals you worked so hard to reach, but they also come with a host of questions. Let’s partner to help you ensure your retirement plans become your reality. We can help you personalize your experience to ensure your money lasts throughout retirement and beyond.

College Planning

5 in 10 parents of children under 18 (50%) haven’t started saving for their children’s college education but want to. College expenses have risen considerably over the years, making it difficult for many families to afford without accruing debt. Fortunately, there are multiple ways to start a college fund. Know your options to make an informed decision.

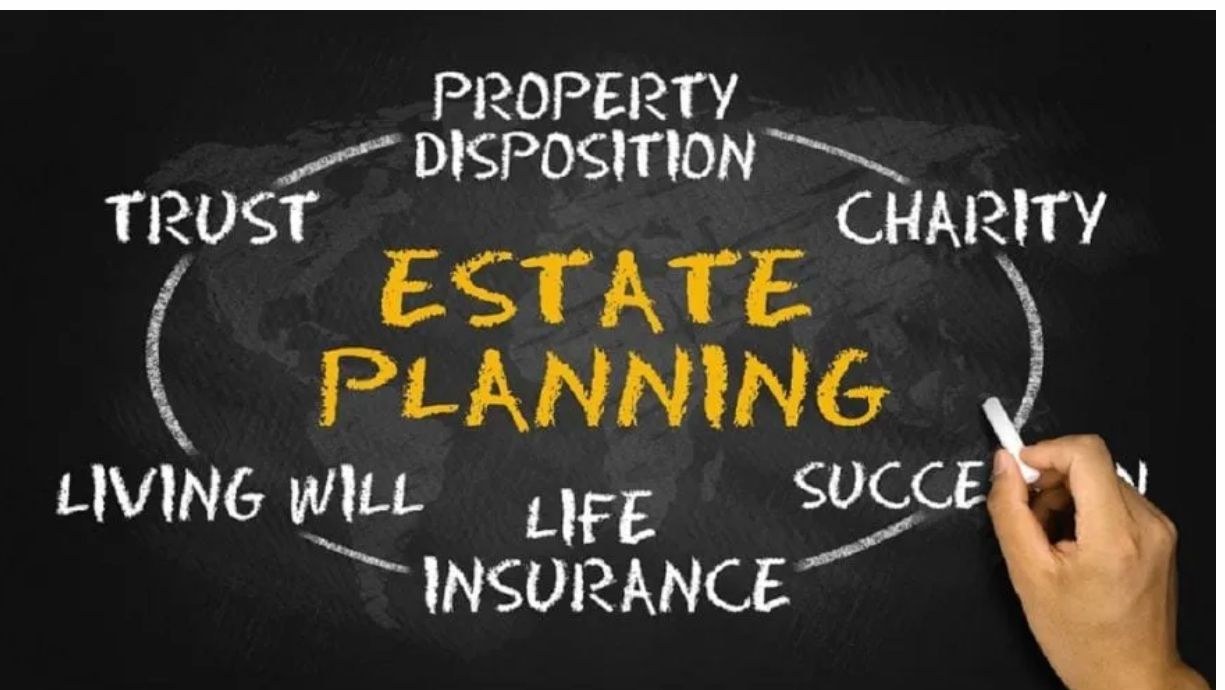

Estate Planning

An estate plan can help you control the transfer of wealth, fulfill your philanthropic goals and minimize taxes. A Trust can be an important element of your estate plan, offering the flexibility you need to meet a variety of short and long-term planning goals. Our team can provide guidance in creating an effective estate plan that will live a lasting legacy for your generation.

Long Term Care

It is crucial to plan for the unexpected, especially when it comes to your health. After all, it only takes one major health issue to have a severe impact on your finances. If you live long enough, you’ll most likely require some long-term care. We can help create that long-term care plan for you and your family members so that you can have a peace of mind.

For Better Money Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo

Let’s Talk

Affiliation

News From our Blog

Retirement is an exciting stage of life that many Americans eagerly anticipate, yet retirement as we’ve known...

The comfort and simplicity of cash can be enticing; it’s tangible, easily accessible, and feels safe. While...

Estate planning is one of the most important things we can do for the people we love...

Subscribe to Newsletter

Contact US

Ready to take control of your financial future ? Contact us by phone of email or simply fill out this form for quick assistance with any questions. We are here to help you every step of the way !